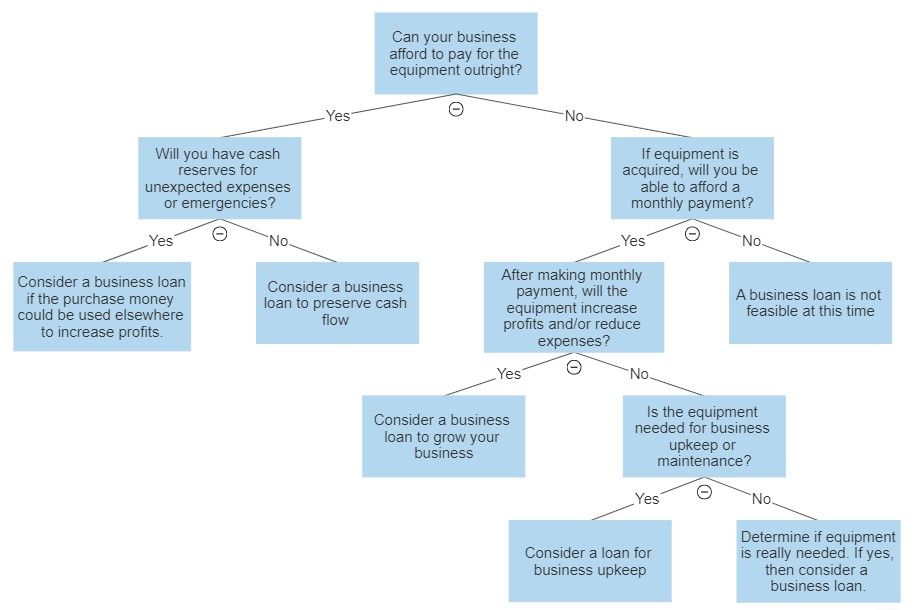

How do you know if an equipment loan is right for your business? One of the first questions to ask is, “Can I afford to purchase the equipment?” Funds may not be available to pay for equipment outright, but this doesn’t mean the equipment is out of reach. You may easily be able to afford a loan with monthly payments. In fact, monthly payments are often a better choice than paying for equipment outright. Why? In many cases, it is more profitable to use your cash in other ways (e.g. investments, customer acquisition, inventory). Or it may be more beneficial to preserve your cash flow for unexpected expenses or emergencies (look what happened to many businesses with Covid).

You might ask, “How do I know what my monthly payment will be?” Many factors can affect your monthly payment amount including length of time in business, business credit history, the financial condition of your business, and loan length to name a few. You can use online loan calculators to help estimate payments. EMR Finance can also assist you with determining your monthly payment amount (without affecting your credit score).

Once you determine a monthly payment is feasible and the equipment is financially beneficial, then consider obtaining an equipment loan to grow your business. Sometimes equipment (e.g. such as furniture) is needed for business upkeep or necessity, so increasing profits or reducing expenses is not always the deciding factor for obtaining a loan. For help in determining if an equipment loan is right for your business, use the simple flowchart below.

Questions? Contact the experts at EMR Finance today at 972-994-6719.

Ready to apply? Click the link below to begin the application process.